What a week it was, big

announcements from the fed, geo-political tensions grow, and Apple announces

its long anticipated iPhone 5

Want to take a closer look? Let’s go!

Step right

up folks; Get your stimulus, this one’s going to be big!

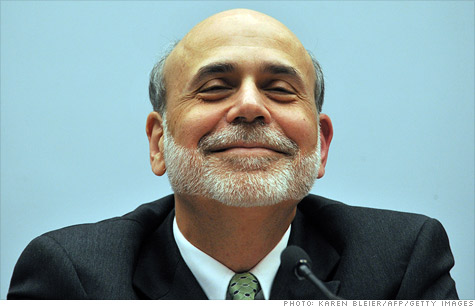

First and foremost the biggest news this week was Federal

Reserve Chairman Ben Bernanke’s announcement of another attempt at stimulating

the sluggish American economy, QE3 (the 3rd Quantitative Easing):

Like a toddler on Christmas day, markets have been

anxiously anticipating the full details of QE3. Here’s what QE3 entails:

Open market purchases of

mortgage backed securities at a rate of $40 Billion per month... Indefinitely!

(well, to be clear, until the jobs markets improve substantially as long as inflation stays contained)

Here’s a part of the official

Fed. statement:

“If the outlook for

the labor market does not improve substantially, the committee will continue

its purchase of agency mortgage-backed securities, undertake additional asset

purchases, and employ its other policy tools as appropriate until such

improvement is achieved in a context of price stability,”

The Fed. also hinted at keep rates (which are already

near rock bottom) unchanged until at least mid-2015. Pushing back earlier

promises to keep rates unchanged till 2014. Yikes...

Market results for the week:

·

US equities gained on the news of QE3

·

The dollar fell broadly

·

Oil prices rose and gold hit a 6-month high

Although, the key metric from QE3 is yet to be determined...

INFLATION! For a more in-depth

analysis of QE3-inflation risk and how to keep your investments safe &

sound, take a look at the below article:

Dispute

over Pacific Islands leads to violence and harms Chinese-Japanese Business

relationship:

Oh my, this does not look good. Asia’s

two largest economies are amidst a heated territorial battle over

Diaoyu/Senkaku islands which is leading to violent

attacks on businesses.

What’s this all

about? In a nutshell, Japan claims to have purchased these islands for nearly

$30 million dollars, China simply does not recognize this purchase and says Japan

is stealing these Islands from them. Now there we’re all caught up to speed,

let’s talk about what’s happening to business between the nations which last

year generated two-way trade of $345 billion.

·

Both Toyota and Honda have claimed that

arsonists have badly damaged plants in China. Honda has halted production in

China for two days – other car makers have followed as well in halting production

in China including Mazda and partner Ford

·

Seven & I Holdings, is said to close 13 Ito

Yokado supermarkets and 198 “7-11” convenience stores in China on Tuesday

following the violent attacks

·

Tech giants like Panasonic have halted

production facilities in China (following an alleged sabotage by Chinese

workers), same goes for Cannon and Sony has discouraged all non-essential

travel to China

Let’s hope this issue reaches

a conclusion soon and business returns to normal. For now though, keep an eye on Japanese depository receipts

traded in China and expect sharp loses.

Is it

really here?

Yes it is! The

moment many geeks and Apple loyalists have been waiting for has finally

arrived. The iPhone 5 is here!

And it’s taller

than ever! This is big news for the economy as a whole as the iPhone has

some quite astonishing affects on GDP; take a look at what some economists are

saying about it:

·

The iPhone 5 could inject $3.2 billion to the

U.S. economy in the fourth quarter or $12.8 billion at an annual rate

·

0.33-percentage-point boost to GDP

With pre-orders hitting a

record high of 2-million units, Apple could be well on it’s to reaching these

estimates and further continuing its super-growth phase

That’s all for this week folks, stay tuned for more

Matthew MacMull